India Policy Watch #1: Knowing Your HandInsights on current policy issues in India—RSJHere’s a conundrum for you. The U.S. equity market is at an all-time high. It is up more than 7 per cent from the day of Trump’s inauguration and about 33 per cent from the time Israel invaded Gaza in retaliation against the Hamas attack back in October 2023. The market has taken everything in its stride - the continued war in Ukraine, failure of multilateral institutions to act on international trade, climate change and global peace, attack on democratic institutions and on academia by Trump, the MAGA madness about America first and the never-ending shenanigans on tariffs. Everything that’s bad for the US economy in the long run and that points to an eventual decline in American might is being discussed and anticipated, but ignored by the market. Or, so it would seem. On the other hand, the Indian equity market is down about 5 per cent in the past 12 months and up by about 20 per cent over the past 2 years. India’s underperformance against emerging markets over the year has been stark. MSCI India has trailed MSCI Emerging Markets by 24 percentage points since September 2024, the longest period of underperformance in the past 15 years. This has happened during a period where it has remained the fastest growing large economy in the world with political stability, fiscal discipline and an improved sovereign debt rating. Even the confidence among analysts that Trump tariffs will not materially impact India, and the recent announcements on reforms, starting with GST rate rationalisation, haven’t moved the needle of confidence among global institutional investors yet. The market seems to be ignoring the long-term strengths of the Indian economy. Why this divergence between the two markets? A couple of days back, I saw a viral clip of the editor of one of India’s largest business news TV networks asking if there was a concerted effort by global investors to keep the Indian market down. The age-old conspiracy theory of the ‘foreign hand’ in keeping India down. That India is threatening the global order with its rise, and larger forces are working overtime to bring it down. Who these larger forces are is never clearly known. It is often Soros. It is sometimes the US deep state. It is never the good, old collective wisdom of the markets. It was only a matter of time before the insanity that rules most of India’s prime time TV news should seep into its business news channels. We are in WhatsApp forwards becoming news stories territory now in business news too. The US equity outperformance isn’t too difficult to understand. Despite all the seeming long-term odds on the political front, there is tremendous confidence in US AI capabilities and its likely global impact in the medium term. Almost 70 per cent of the outperformance can be attributed to AI and Big Tech confidence in what it can do to harness it. The Treasury market continues to keep a lid on Trump’s actions, regardless of his words that aim to take the global order down. The periodic sell-off in the bond market is the basis for the notion that Trump always chickens out. That has meant that, beyond a point, all of the havoc unleashed by Trump has only meant a slight upward movement on long-term yields. Trump is a problem, but it will go away eventually, seems to be the message. How long will this last? I have a sense this is the new equilibrium in dealing with Trump uncertainty. Trump can, of course, make wilder pronouncements, but the bond markets have decided this is peak Trump in terms of real economic impact, and it has factored that in. The relative Indian underperformance is also not a mystery. There’s no global conspiracy here. No one has time for it. It is difficult for global investors to gauge the net impact of the multiple global trends on the Indian economy. The US-China-Russia dynamic, the US-India relationship, which is only trending downward, India-China thaw, the impact of AI on Indian IT services and China muscling in to rewrite the code for global order - these are all material factors that will influence decision-making on investments in India. Right now, these dice are all up in the air. What India needs to do or what it can do to (up to a point) to manage these factors is not insignificant. We have written about these in the last few editions, including speedier closure of bilateral deals with other trade partners, to make doing business easier in India and selling real reforms as the solution to the crises to the Indian voters instead of pitching ‘be Indian, buy Indian’. There is some belated acknowledgement among policy circles that the hand India is sitting on has turned bad, and it will need a real long-term commitment to solutions to get out of this. The GST rationalisation and the speed of decision-making and implementation are a good example of what needs to be done. It was such a no-brainer to rationalise that structure, which would be revenue neutral (and eventually be positive), and make tax compliance so much easier for businesses that to have reached this point after 9 years of muddling should tell you something. There’s a lot more that can be pushed through with a minimal loss of political capital if there’s intent (or compulsion) that is unwavering. Lastly, like many of you, I was impressed and amused in equal measure by Xi’s most visible attempt to flex his muscles and demonstrate China’s readiness to write the new world order or, in his words, ‘orderly multi-polar world’. China speaking of free trade, rule of law, global governance system and multilateralism is all quite rich but who can point a finger at it when the U.S. has voluntarily taken a hatchet to destroy free trade and dump its allies and partners. It is all vague words at this moment, but the impressive display of weaponry and its open challenge to the old economic order is a message that China will now not be bound by the usual niceties and threats from the West. Whatever the term global south means, China is now actively positioning itself as the hegemon to unite it. Somewhere in all of this is a move on Taiwan soon. I’m glad that in all of this, PM Modi wisely stayed away from the display of military hardware. The sight of Xi, Putin, Kim and Shahbaz Sharif arriving together for the military parade should dampen the great enthusiasm with which the BJP and its supporters showcased PM Modi’s trip as a response to Trump. If this is the leadership of the new world order, India should rethink a bit on how much fun and laughter it should be seen having with Xi. Just to jog your memory a bit, back in October 2019, Modi and Xi were sitting on a swing together at Mamallapuram and cooing at each other. In May 2020, we had the skirmish at Galwan and the PLA laying claim on Indian territory. From there onwards, it went all downhill. For all the newfound love for China and visible demonstration of strategic autonomy, India will do well to remember 2020. All it will take is another Pakistani-sponsored terror attack or a PLA misadventure next summer for India to realise how lonely it can get in this multi-polar world that China is advocating. A photo-op in front of hypersonic missiles now was, therefore, best avoided. Global Policy Watch: The China AI Hype CycleGlobal policy issues relevant to India—Pranay KotasthaneThe State Council of China released a paper titled Opinions on Deeply Implementing the 'Artificial Intelligence Plus' Action on August 26. For the uninitiated, AI+ is the name of China’s campaign for AI development. Last week’s paper is a policy plan for the government and industry to focus on six areas for AI deployment. These are science & technology, industrial development, consumption, livelihood, governance, and global cooperation. It sets vague targets for AI adoption in these six areas, calling for a 70 per cent adoption of “new-generation intelligent terminals, agents and other applications” by 2027, and a 90 per cent adoption by 2030. It also identifies eight pillars of building foundational capabilities in AI—models, data, computing power, applications, open source, talent, policies & regulations, and security. For a detailed translation and commentary, check out this post at Geopolitechs. As soon as this paper was released, the media narrative was that by identifying near-term targets, China was adopting a more practical, down-to-earth AI strategy as opposed to the US, which is engrossed with AGI moonshots. The implication was that China would succeed precisely because it was chasing pragmatic goals. The Wall Street Journal’s Josh Chin & Raffaele Huang make a similar argument:

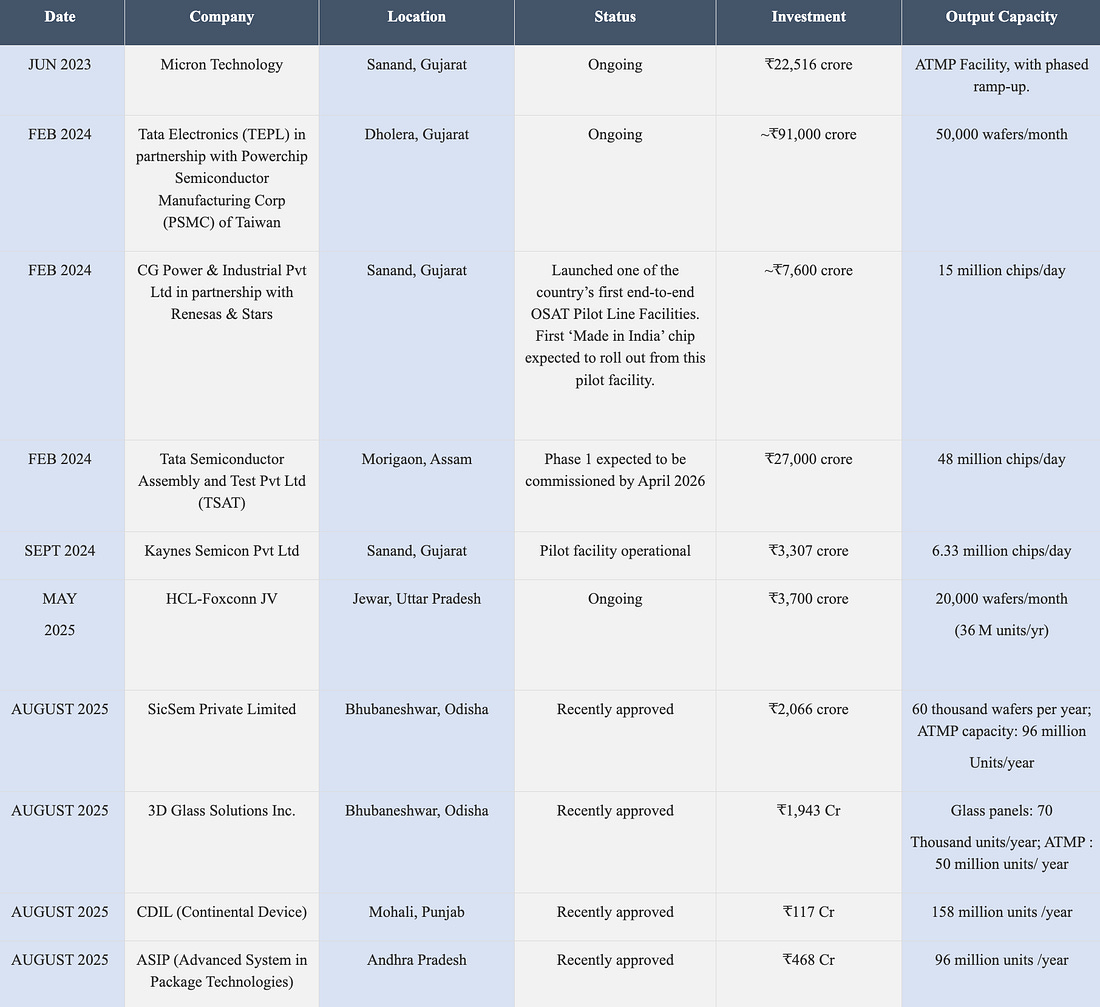

But this dichotomy masks essential differences. One, DeepSeek and Alibaba have always said their end goal is AGI. And there are thousands of US companies beyond the OpenAIs and Anthropics, which are also doing the pragmatic applications identified by the Chinese State Council. Next, targets are central to the Chinese command and control system. These targets will become guidance for provincial and local governments. Promotion of party-state officials often depends on meeting centrally defined targets such as these, hence the need to outline numerical targets. The targets themselves are pretty vague. What does a 70 per cent adoption of “new-generation intelligent terminals, agents and other applications” even mean when you can label any LLM wrapper as AI? But the purpose is to signal to the governments and industry that the CPC wants AI adoption to happen quickly. The plans are no guarantee for success, but they help mobilise resources. For example, in 2015, the “Made in China 2025” strategy set a goal of achieving 40 per cent self-sufficiency in semiconductors by 2020 and 70 per cent by 2025. But it's likely to only reach 30-35 per cent self-sufficiency by the end of 2025. Nevertheless, the target serves as a signalling device to all stakeholders. Third, the US, too, has an Action Plan that was released last month. It focuses on three pillars: innovation, AI infrastructure, and AI diplomacy. India's National Strategy for Artificial Intelligence was released in 2018, and it identified five focus areas and seven pillars, much like the China AI Plus initiative has done now. These points apart, the AI+ plan is indicative of two things about China’s AI strategy. One, it is leaning further on technology to improve its economic fortunes. Since sectors such as real estate aren't leading to productive outcomes, the CPC has shifted investment focus towards the technology sector over the past decade. The core purpose is to mobilise billions of dollars into AI data centres, AI chips, and AI applications with the hope that it will generate some top-notch players, even if misallocation of capital leads to wastage, corruption, and failures. More importantly, this plan is to prevent overinvestment in AI hardware and data centres, a goal that many provinces and cities are blindly chasing. The policy encourages firms and governments to look beyond these. Conversely, the CPC will also not want any AI breakthrough that can challenge its standing. Hence, the focus is on applications and practical implementations. Look beyond the hype. India Policy Watch #2: SEMICON India v4Insights on current policy issues in India—Pranay KotasthaneEarlier this week, the fourth edition of India’s flagship semiconductor industry event took place. Here are some highlights and lowlights:

HomeWorkReading and listening recommendations on public policy matters

|

#315 Beyond the Hype

18:06

0